Add Accounts Payable Invoice

Invoices that have not been paid are entered using the Accounts Payable Programs. Accounts Payable keeps track of money your company owes to Vendors.

TUTORIAL SCENARIO:

We will assume we have received an invoice from ACME OILFIELD SERVICES.

It has 2 line items (charges).

$100 for Trucking and Hauling and $100 for Labor and Installation.

The work was done on Well #1 of our Sample Data.

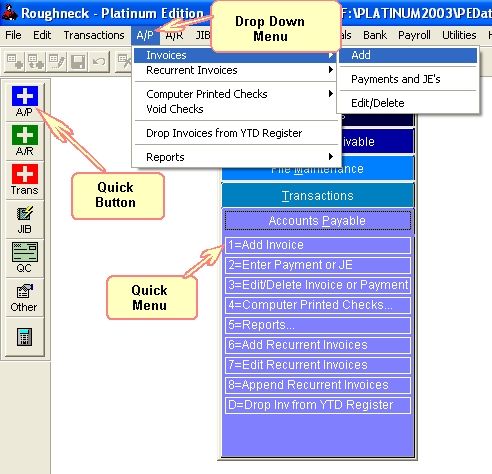

There are 3 ways you can get to the Add A/P Invoice Screen, as well as several other operations. It doesn't matter which method you use. The Quick Menu and Quick buttons are designed to save you time when you become more proficient.

1) From the Drop Down Menu, select A/P, select Invoices, then Add.

2) From the Quick buttons on the far left of the Main Screen, you can click on the +A/P button.

3) From the Quick Menu, select Accounts Payable, then Add Invoice.

The system displays a Full Screen Layout for Invoices.

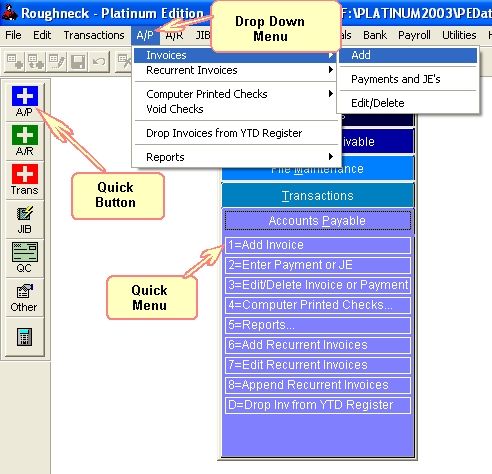

Add the first charge on the make believe Invoice for Trucking & Hauling.

If you look on your List of Vendors, you will see that Acme Oilfield Services is Vendor Number 10000.

If you look on your Company Chart of Accounts, you will see that Trucking & Hauling is GL Number 71330.

If you look on your list of Units/Wells, you will see that Well #1 is Unit Number 10000-01.

We will assume the DOI Status Level for the well is 1.

Fill in the data as shown above.

Click Save to save the info, and then Continue, to add the next item on the Invoice. (Most invoices have more than one charge)

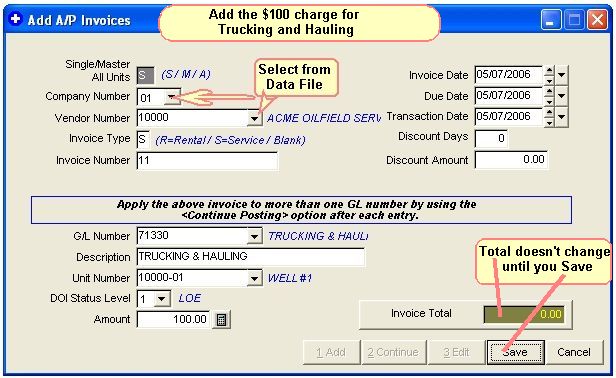

Note, that since we selected Save then Continue, all the info at the top of the screen remains the same.

Change the GL Number as shown in above image to reflect that charge. We could also change the Unit Number (Well Number), if needed, but for the tutorial we will leave it the same.

Note: GL Number 21000 is hard coded for Accounts Payable. Roughneck will make an automatic Credit to that GL Number for Accounts Payable Invoices. See GL Number Restrictions.

Click Save then Exit.

We have finished adding an AP Invoice into the system.

NOTES ON A/P INVOICE FIELDS

For Fields not used, or to accept the Default Value for a Field, you may depress the <enter> key to bypass.

INVOICE NUMBER: You can use up to 19 characters for the invoice number. Alpha characters are acceptable.

Note: To enter a credit Invoice, the last character of the Invoice Number must be a "C".

TYPE (R/S/BLANK): To enter a Service or Rental Invoice, type in "S" or "R" respectively. This is appended to the end of the invoice number automatically. When invoices are Paid, Government Form 1099 values are updated in the Vendor file only if type is "R" or "S". Leaving this blank will not update any Government Form 1099 values in the vendor file.

INVOICE DATE: This date always defaults to the Transaction Date, but may be changed. It is the date the invoice was incurred. The default Transaction Date always defaults to Today's Date, but can be changed by using Change Default Transaction Date.

DUE DATE: Date the Invoice becomes due. This date initially defaults to the Transaction Date. It is re-calculated after entering the Invoice Date from the Terms of the Vendor as stored in the Vendor file. The Terms of the Vendor, as stated in the Vendor Master file, are added to the Invoice Date to determine the Due Date.

TRANSACTION DATE: This date is used when specifying Beginning and Ending Dates for Operating Statements, Period Close routines, etc… For the Training Session use the default Transaction date for all entries, such as 05/07/2006. The default Transaction Date always defaults to Today's Date, but can be changed by using Change Default Transaction Date.

Tip on Dates: You can use a Quick Key to quickly insert dates into the date field.

DISCOUNT DAYS: Number of days within which you can pay the invoice and receive a discount.

DISCOUNT AMOUNT: This is the actual amount (not percentage) of the discount if you pay the invoice early (within the specified number of Discount Days).

G/L NUMBER: This is the Expense General Ledger Number that is debited. Do not use the Accounts Payable G/L Number 21000. Roughneck automatically posts a credit to Accounts Payable GL number 21000. Debits and credits are stored in the Transactions File. Investors are billed their share for G/L #’s in the range of 71001 to 75999 when Operating Statements are printed. See GL Number Restrictions and Accounting for Dummies for more.

DESCRIPTION: This is any Extra description you want printed on the Operating Statements for the Investors. The description of the G/L account is always printed and sometimes that is enough. But if you want more than the G/L description, enter it here.

UNIT NUMBER: This is normally the Well Number but the Unit Number could, in special situations, be used to denote a Group of Wells, a Lease, etc... Most operators always use this Number to designate a specific Well, but the choice is yours.

DOI STATUS LEVEL: Used to indicate which percentage in the DOI file to use for billing the Investors. In the Division of Interest file each Investor can have up to 8 different percentages on a Unit. For example, a percentage for Drilling, Completion, Normal Operating, etc… The status entered here for each transaction indicates which Expense percentage to use for investors from the Division of Interest File. For Example, if the status to use is 2, for Revenue, Tax, and Expense Transactions, then the percentages used from the DOI file would be REV2, TAX2, and EXP2. The status initially defaults to the status stored in the Unit file allowing you to depress the <enter> key to accept the default value. If no Unit Number is entered the Status defaults to 0.

AMOUNT: This is the amount for the line item of the invoice. If there is only one line item on an invoice, then of course this amount is the total amount.

NOTES ON POSTING TO MASTER UNIT:

The gross amount of invoice will be divided evenly among all units that belong to the master unit. Any rounding of pennies will be distributed to the last unit within the master unit if necessary. After the gross amount of invoice has been distributed evenly to each well, then that amount will be distributed accordinly to each investor as to what their individual percentage is.

STATUS LEVEL: The default status of each unit in the Unit/Well file will be used for billing Investors.

NOTES ON POSTING TO ALL UNITS

The gross amount entered for this invoice will be divided evenly among all units that belong to this company. A company may charge amounts such as postage to all units. You may set the company up as a vendor in the Vendor file. Most companies post a JED payment application to the Accounts Payable invoice and credit income for the postage charged. Other companies may wish to cut a check for the Accounts Payable invoice to the company as a vendor.

The gross amount of invoice will be divided evenly among all units that belong to this company. Any rounding of pennies will be distributed to the last unit that belongs to the company. General ledger numbers 71001 to 75999 are used to bill Investors for expenses when printing Operating Statements. Any other general ledger number and Investors are not billed.

FILES UPDATED WHEN ADDING AP INVOICES

APDET - The Accounts Payable Detail file. The invoice will reflect the total amount of the invoice for all line items.

APREG - Posting Register for Accounts Payable.

TRAN - For a normal invoice: The specified general ledger number is debited for each line item and each unit, Accounts Payable (general ledger number 21000) is credited for the total amount of the invoice for all line items. For a credit invoice: The specified general ledger number is credited for each line item and each unit, Accounts Payable (general ledger number 21000) is debited for the total amount of the invoice for all line items.

VENDOR – Year to date balances, year to date 1099 rental/service, year to date fed withhold tax or year to date state withhold tax when Accounts Payable invoices are paid.

Reports To Verify Accounts Payable Entries

Monthly Transaction Listing - Should contain every debit and credit entered and total to zero.

A/P Posting Register - The Period Total of this register should always equal the Period Totals in the Monthly Trial Balance for GL Number 21000 - Accounts Payable.

A/P Inquiry Report - The Company total of this report should always equal the Ending Balance for the Company in the Monthly Trial Balance report for GL Number 21000 - Accounts Payable.

Monthly Trial Balance - Should balance to zero, and the period totals for Accounts Payable should be the same as the period totals for their respective Posting Registers (when using the same beginning and ending date).

Related Topics

How to Edit or Delete AP Invoice, Payment or JE ~ How to Print Computer Checks for AP Invoices ~ How to Use ReCurrent (Repeating) AP Invoices ~ How to Track Accounts Payable on Unit by Unit Basis ~ Accounting for Dummies ~ GL Number Restrictions ~ Government Forms

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.